十年来,中国经济规划者一直用低廉的电价有效地补贴工业部门。由国家发展和改革委员会(NDRC)控制的电价,一直保持着低廉水平,以至于电力生产商(发电企业)和分销商(这里意指电网企业及其所属的各地电力公司——译者注)的平均资产回报率,长期明显低于这些资产的融资成本。因为工业领域的能源使用强度高于服务行业,所以工业类公司不成比例地受益于低廉的电价。这种畸形情况可能正在发生变化。

发电企业重获活力

首先,决策者更多地依靠市场来给火电定价。中国80%的电力生产来自于煤炭,因此煤炭本应对电价产生巨大影响。以前,政府控制了电煤合同价格的形成基础和电网付给火电生产商的价格,这使火力发电厂受到挤压,缓解了终端用户价格上涨的压力。

这一体系在2013年进行了调整。中国国家发改委同意停止设定火力发电厂和煤碳企业间签订的合同煤的基准价格。现在,双方可以根据煤炭的现行市价,自由协商电煤合同价格。

发改委还引入了市场力量,来规范电网付给火电厂的价格 (或称“上网电价”)。现在,如果煤炭价格浮动5%及以上,上网电价也将随之上涨或下跌。

截至目前,更大程度上以市场为导向的定价机制提高了火电企业的盈利能力。2012年初以来,煤炭价格逐步下降,使火电厂成本降低。尽管火电厂投入成本降低,但直到2013年底上网电价都未下调,这增加了火电企业的利润。

目前,电网公司支付给火电企业的价格可能是十年来首次接近市场均衡水平。这在这一事实中得以体现,即现在火电企业的资产回报率略高于银行对大多数国有火电企业的最优惠贷款利率5.6%(优惠贷款利率反映了火电企业的资金成本)(见图表1)。

电网企业及其所属的各地电力公司正将更多成本转嫁给用户

其次,电网公司(主要是国家电网公司和中国南方电网公司及其所属各地电力公司)现在可以把更多的火电价格成本转嫁给终端用户。在市场环境下,为了应对更高的火电企业的上网电价,电网公司应该提高销售价格。然而,在中国这种情况不会发生,因为发改委控制着终端用户支付给电网公司的价格。

由于近期的改革,这种情况有了改变。2012年,发改委确立了一个包括三档的居民阶梯电价制度,对消耗较多电量的家庭执行较高的电价。2013年12月,当发改委宣布对铝业企业实施三档阶梯电价制度时,也最终将此覆盖范围扩大到所有工业部门。在中国,有色金属(主要是铝业)的冶炼和冲压是第三大电力消耗部门,仅排在钢铁业和化工业之后。

改革减少了电网公司及各地电力公司的损失。但在过去的两年里,由于电网企业原材料成本的上升速度比其收入增速还快,电网公司的利润有所下降。

然而,与以前相比,这仍是一种进步(见图表2)。在2001-2004年间,电网企业成本增长幅度和收入增长幅度之间的差距更大,2008-2009年间这一差距甚至高达近三倍。

电网企业将上涨的生产成本转嫁给终端用户的幅度,可以通过有效电价来衡量。2011年,电网公司收取的有效电价为0.66元人民币/千瓦时,2013年这一价格持续上升到0.75元。

电力改革的大局

理论上,如果取消电价补贴,由市场决定价格,那么电价应该会继续上升,直到发电企业和电网企业的资产回报率与资金成本相等。由于火力发电厂和电网企业的加权平均资产回报率从2011年的0.2%上升到2013年的3.9%,所以两者的差距有所减小。但该行业的资产回报率仍远低于平均优惠贷款利率,该利率反映了他们的资金成本(见图3)。

目前仍不能肯定改革是否能继续下去。金融危机后,2008—2012年间,政府通过压低电力企业利润来刺激经济成为宏观调控政策的一部分。如果煤炭价格再次上升,政府仍可完全控制终端用户价格,从而限制电网企业将上涨后的上网电价成本转嫁给终端用户。电煤价格年浮动5%时上网电价才能进行相应调整,这也对再次挤压火电企业利润留下了巨大空间。

另一方面,如果电价市场化改革继续下去,这可能会导致价格上升。对于制造业来说,更高的电力价格将成为另一个挑战,因为制造业已经面临着劳动力成本、资金成本、人民币汇率上升的压力。一些公司将会继续在这一困境中挣扎,另外一些企业则会通过压缩成本并提高产品的附加价值而获得成功。

制造业进一步受到的电力价格压力,可能会使其增长速度慢于服务业。去年是1960年以来,服务业占GDP比重首次超过第二产业。随着中国继续推进市场决定电价机制改革,我们预计服务行业仍将是主要的受益者。

(第一智库网初步摘译,仅供参考)

Rebalancing and Rising Electricity Prices in China

For a decade Chinese economic planners have effectively subsidized the industrial sector with low electricity prices. The price of electricity – controlled by the National Development and Reform Commission (NDRC) – has been kept so low that the average returns on the assets of electric power producers and distributors have been significantly below the cost of financing those assets. Firms in the industrial sector disproportionately benefit from low electricity prices because their energy intensity is higher than firms in the service sector. These distortions may now be changing.

A recovery for electric power producers

First, policymakers are relying more on markets to price thermal power. Coal is utilized for 80 percent of China’s electricity production and should have a large impact on electricity price. Previously, government controls on coal contract pricing and the price the grid pays thermal power producers squeezed thermal power plants and reduced pressure to raise end users prices.

This system was adjusted in 2013. The NDRC agreed to stop setting a benchmark price for coal contracts between thermal power plants and coal mines. Now the two parties can freely negotiate contract prices based on the prevailing market price for coal.

NDRC also introduced market forces to the price the grid pays thermal power plants (or the “on-grid tariff’). The on-grid tariff will now rise or fall if coal prices change by 5 percent or more.

More market-oriented pricing has improved the profitability of thermal power producers so far. Coal prices have fallen progressively since the beginning of 2012, driving down the input costs. The on-grid tariff was not reduced to reflect this lower import cost until the end of 2013 . This drove up profits for thermal power producers.

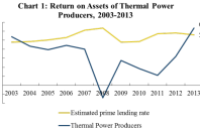

The price thermal power producers are charging the grid may now be closer to market equilibrium for the first time in a decade. This is reflected by the fact that the return-on-assets of thermal power producers now slightly exceeds the prime bank-lending rate of 5.6 percent – a proxy for the cost of capital – for mostly state-owned thermal power companies (see chart 1).

Chart 1

Electric distributors are passing on more costs to users

Second, grid companies (owned primarily by State Grid and China Southern Power Grid) are now able to pass on more thermal power prices to end-users. In a market environment grid companies should raise prices in response to a higher on-grid tariff for thermal power companies. In China this does not happen because the National Development and Reform Commission (NDRC) controls the price end-users pay the grid.

This has changed with recent reforms. In 2012, NDRC launched a three-tiered electricity pricing system to charge higher rates to households consuming more electricity. In December 2013, National Development and Reform Commission (NDRC) finally expanded the tiered pricing approach to the industrial sector when it announced a three tiered pricing system for the aluminum sector. Non-ferrous metal smelting and pressing – including mostly aluminum – are the third largest consumer of electricity in China after steel production and chemical products.

Reforms have reduced the losses for distributors. In the past two years, the profitability of grid companies has declined as the costs of goods sold for grid companies rose faster than revenues.

However, this is an improvement from the past (see chart 2). The gap between cost growth and revenue growth was higher in 2001 to 2004, and nearly three times higher from 2008 to 2009.

The increased pass through of higher electricity costs to end users can also be measured by looking at the revenues of grid companies per unit of electricity consumer or the effective electricity price. In 2011 the effective electricity price charged by the grid was 0.66 Rmb per Khw, since this has continued to rise to 0.75 percent in 2013.

Big picture of electric power reform

In theory, if electric price subsidies were to be eliminated, as prices become more market determined, they should continue to rise until the return-on-assets of power producers and distributors equals the cost of capital. The gap has narrowed as the weighted average returns on assets of thermal power plants and electric power distributors rose from 0.2 percent in 2011 to 3.9 percent in 2013. But return on assets of the sector is still well below the average prime lending rate, a proxy for their cost of capital (see chart 3).

It is not clear whether progress will continue. In 2008 to 2012, returns were suppressed by the state as part of a broader effort to stimulate the economy following the financial crisis. If coal prices rise once again, the state still has complete control over end user pricing, thus can limit pass-through of rising on-grid tariffs. The 5 percent threshold for annual adjustment to on-grid tariffs also leaves plenty of room to squeeze thermal power producers once again.

On the other hand, if market price reforms to electricity pricing continue, this will likely lead to higher prices. Higher prices will be an additional challenge to a manufacturing sector already struggling with rising labor, capital, and exchange rate costs. Some firms will struggle while others will succeed by focusing more on improving the value of their products as cost savings decline.

Additional price pressures in the manufacturing sector will like slow its growth relative to the service sector. Last year was the first year since 1960 in which the service sector was a larger share of GDP than secondary industry. As China continues to move to a more market determined price for electricity, we should expect the service sector will continue to be the primary beneficiary.